At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., xero review 2020 owner’s equity amounting to $100,000). The rights or claims to the properties are referred to as equities.

Financial statements

The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount.

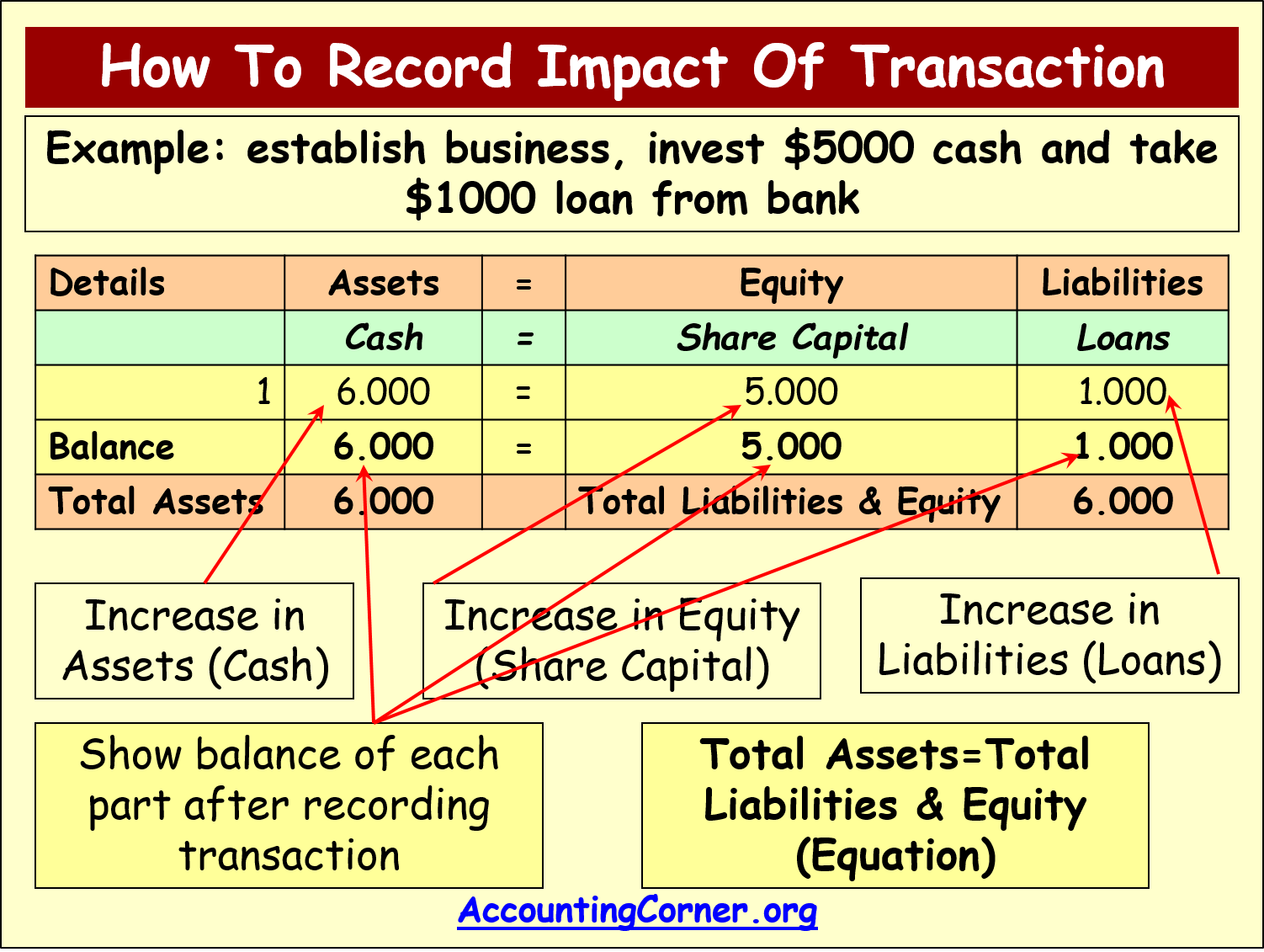

Let us take a look at transaction #1:

Think of liabilities as obligations — the company has an obligation to make payments on loans or mortgages or they risk damage to their credit and business. This number is the sum of total earnings that were not paid to shareholders as dividends. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background.

Arrangement #1: Equity = Assets – Liabilities

For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). With the accounting equation expanded, financial analysts and accountants can better understand how a company structures its equity. Additionally, analysts can see how revenue and expenses change over time, and the effect of those changes on a business’s assets and liabilities.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment.

- As transactions occur within a business, the amounts of assets, liabilities, and owner’s equity change.

- The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount.

- The basic concept of accounting equation is to express two main points in the accounting rule.

It’s a tool used by company leaders, investors, and analysts that better helps them understand the business’s financial health in terms of its assets versus liabilities and equity. These elements are basically capital and retained earnings; however, the expanded accounting equation is usually broken down further by replacing the retained earnings part with its elements. The accounting equation relies on a double-entry accounting system. In this system, every transaction affects at least two accounts.

The basic accounting equation at a glance

The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities. Because it considers assets, liabilities, and equity (also known as shareholders’ equity or owner’s equity), this basic accounting equation is the basis of a business’s balance sheet. The owner’s equity is the balancing amount in the accounting equation. So whatever the worth of assets and liabilities of a business are, the owners’ equity will always be the remaining amount (total assets MINUS total liabilities) that keeps the accounting equation in balance.

On the other side of the equation, a liability (i.e., accounts payable) is created. Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation. The business has paid $250 cash (asset) to repay some of the loan (liability) resulting in both the cash and loan liability reducing by $250. The company acquired printers, hence, an increase in assets. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash). If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation.

On 28 January, merchandise costing $5,500 are destroyed by fire. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. On 2 January, Mr. Sam purchases a building for $50,000 for use in the business. The impact of this transaction is a decrease in an asset (i.e., cash) and an addition of another asset (i.e., building).